Our Home Loan Products

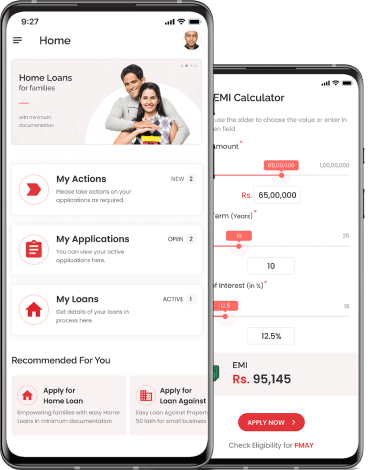

Elevate your experience with the India Shelter iServe App!

Discover a comprehensive range of services, including home loan, loans against property, and much more, all in one place.

- Apply for a loan online, anytime, anywhere!

- Easy payment of dues

- Login and check real-time loan status

- A built-in loan EMI calculator

Scan & Download

EMI Calculator

India Shelter at a glance

At India Shelter, we believe in the power of a safe and secure home. For over a decade, we've been dedicated to making home ownership dreams come true for many families across India. Our motto is simple: to provide affordable and accessible housing solutions, making a difference one home at a time.

Learn More

States

+

AUM (Cr)

*as of 31st December 2023

Our Delighted customers: Discover their stories

Gain insights into the journeys of those who have chosen us.

Blog

Explore our blog to make the most of your journey and let us be your trusted companion on the path to securing your dream home and financial well-being.

FAQs

What documents are required to apply for a home loan with India Shelter?

What is the interest rate offered by India Shelter for home loan products?

How does Loan Against Property work?

What is a balance transfer for a home loan?

How do I contact India Shelter Finance Corporation for applying for a home loan?

Who is eligible to apply for a home loan with India Shelter?

We value your privacy

We use cookies to enhance your experience on our website. By clicking on accept you consent to our use of cookies in accordance to our privacy policy

Disclaimer: *By contacting IndiaShelter on Toll Free/WhatsApp/Website or any other mode, you authorize our representatives to reach out to you through personal communication via SMS, WhatsApp and phone calls regarding our services. This consent will supersede any registration for any Do Not Call (DNC) / National Do Not Call (NDNC).

© India Shelter Finance Corporation 2024 | All rights reserved

Design with byCyberworx