About Purchase + Construction Loan

At India Shelter, we understand that the journey to your dream home involves more than just finding the perfect plot or envisioning the ideal design. It requires solid financial support. Our Purchase + Construction Loans are tailored to provide you with the financial flexibility needed to bring your dream home to life.

Attractive Interest Rates

Loan amount between INR 5 Lakhs to INR 50 Lakhs

Assistance on phone

Quick and hassle-free loan processing

Expert guidance

Transparent and customer-centric approach

ITR not mandatory

Benefits Of Purchase + Construction loan

Advantages of various features of Indian Shelter Purchase + Construction Loan

Flexible Financing Options

India Shelter offers a range of financing options to suit your needs. Whether you're purchasing a plot, constructing a new home, or both, our flexible loan structures are designed to accommodate your unique requirements.

Competitive Interest Rates

Benefit from competitive interest rates that make your dream home more affordable. Our transparent loan terms ensure you have a clear understanding of your financial commitments.

Streamlined Approval Process

Time is of the essence, and we recognize the urgency in realizing your dream. Our efficient approval process ensures that you receive the financial support you need promptly.

Comprehensive Support

Our dedicated team is here to guide you through the loan application process. From understanding eligibility criteria to documentation requirements, we provide comprehensive support at every step.

Eligibility Criteria for Purchase + Construction Loan

*Ensure all documents are valid and not past their expiry date (in the case of Driving License and Passport).

Who Can Apply for Purchase + Construction Loan

Property Ownership

Property Value

Age

Income

Credit Score

Documents Required for Purchase + Construction Loan

Identity proof for Salaried People

- Passport

- Voter ID

- Aadhar Card

- Driving License

Address Proof for Salaried People

- Passport

- Voter ID

- Aadhar Card

- Electricity bill/ water bill/ telephone bill

- Driving License

Proof Of Income for Salaried People

- Salary Slips/Bank Statement/Form 16

- Salary Certificate

Other Documents for Salaried People

- Signed Application Form with Picture

- Cheque For Processing Fee

- Bank Statement of Last 6 Months

Property Documents for Salaried People

- Title Deeds of the Property

- Proof of No Encumbrances on the property

Identity proof For self-employed people

- Passport

- Voter ID

- Aadhar Card

- Driving License

Address Proof For self-employed people

- Passport

- Voter ID

- Aadhar Card

- Electricity bill/ water bill/ telephone bill

- Driving License

Proof Of Income For self-employed people

- IT Returns and/or Financial Statements of last 3 years And/or

- Informal Income Documents

Other Documents For self-employed people

- Signed Application Form with Picture

- Cheque For Processing Fee

- Proof of business existence

Property Documents For self-employed people

- Title Deeds of the Property

- Proof of No Encumbrances on the property

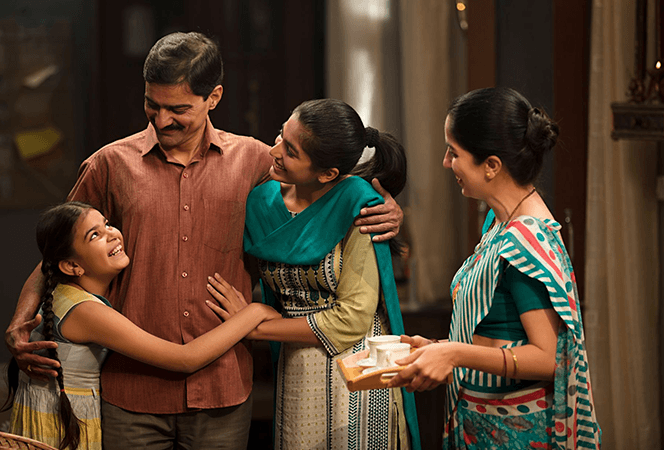

Reviews and Ratings

Authentic experiences through the voices of our valued customers

FAQs

What is an India Shelter Purchase + Construction Loan?

What are the eligibility criteria for the India Shelter Purchase + construction loan?

Can I apply for this loan for renovations or additions to an existing property?

How can I apply for the India Shelter Purchase+ Construction Loan?

What types of properties are eligible for this loan?

Disclaimer: *By contacting IndiaShelter on Toll Free/WhatsApp/Website or any other mode, you authorize our representatives to reach out to you through personal communication via SMS, WhatsApp and phone calls regarding our services. This consent will supersede any registration for any Do Not Call (DNC) / National Do Not Call (NDNC).

© India Shelter Finance Corporation 2024 | All rights reserved

Design with byCyberworx